Rich People Pay Too Much Tax, Argues Champion Of The Common People Joe Hockey

This doesn't sound good.

Between the Dyson Heydon fundraising scandal, the Cabinet leaks of instructions telling ministers to talk up how well the government’s doing, the dimly-received declaration of war against “lawfare” green activists who challenge environmentally damaging projects in court, and revelations that we might be waterboarding people on Nauru, maybe, the constantly rolling pile of wet animal hair and household dust that is the federal government of Australia had an absolute ripper time last week.

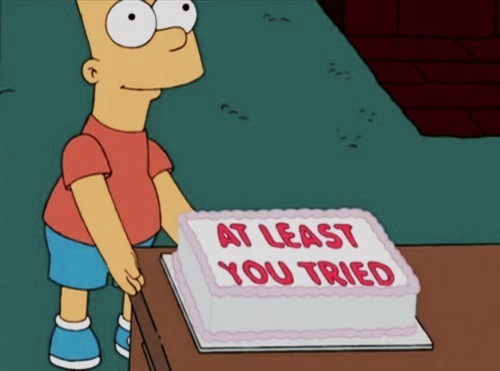

The government’s popularity is so robust that Tony Abbott’s rating as preferred Prime Minister is only six percentage points behind Opposition Leader and sad bobblehead doll Bill Shorten, which is the closest thing real life can ever come to resembling a ‘You Tried’ sticker.

Episode #209 of Good Government: Tony Gets a Cake.

Now Treasurer and Regular Guy Just Like You Joe Hockey is looking to put that immense political capital to work, preferably for an hourly rate below the minimum wage on a contract that doesn’t include penalty rates or overtime. In a speech to the Tax Institute and Chartered Accountants (Australia and New Zealand) in Sydney this morning, which is no doubt going to kick on into the underground rave party of the century this afternoon, Hockey outlined a plan to cut personal income tax rates if the Coalition win the next election.

Noting that our top tax bracket, which begins at $180,000, is “is extremely low when compared with other OECD nations,” Hockey argued that slugging people earning that much with high taxes is “seeing some of our best and brightest move to lower-tax countries” and that fear of falling into a higher tax bracket is “reducing the incentive for many Australians to work harder, earn more and invest,” which sounds like a pretty nice problem to have, really.

In fairness, Hockey’s claim that our top tax bracket is relatively low isn’t egregiously idiotic, like the time he suggested people should be able to dip into their superannuation funds to buy a house. Australia’s personal income tax rate is higher than in places like the United States, where you can earn more than $600,000 before you fall into the top tax bracket, or major European countries like the UK and Germany.

But we also derive more than 70 percent of our tax money from personal income and corporate taxes, and it’s the only source of tax money that’s growing rather than shrinking; raising the income tax threshold for wealthier people would deprive the government of one of its biggest sources of money. That’s a bizarre thing to do considering we’re running pretty short of revenue sources at the moment anyway, and the budget deficit has gone from ‘dubious political distraction’ to ‘thing economists are starting to get very worried about‘.

The prospect of tightening one of Australia’s largest sources of tax revenue also sits kind of awkwardly with Hockey’s other self-described intention to have a “mature debate” about where we can find likely new sources of cash in the tax system. That’s a great idea– or it would be, if he hadn’t already ruled out plenty of sensible reforms that would disproportionately affect the wealthy. As economist Saul Eslake pointed out on ABC News Breakfast this morning, there are a bunch of potential revenue goldmines favoured by the rich — things like capital gains, trusts, negative gearing and superannuation contributions — that get taxed pretty gently under the current system and could generate a stack of revenue if we tweaked them, but which the government has shown no inclination to go after.

Minus those options, all we’re left with are tax reforms like increasing the GST, that mean poorer people will pay more than they do already. If Hockey gets his way and personal income tax rates are massaged to give higher earners some more breathing space, the gap in funds will have to be filled somehow, and given the government’s history it’s pretty likely people less well-off will end up getting slugged more — either at tax time, or just while doing the shopping. It’s not “get a good job that pays good money,” but it is another step on Joe Hockey’s long quest to be carried around everywhere by bare-chested workers in a palanquin.