How The Government’s Changes To HECS Will Impact Millions Of Australians

Even if you graduated years ago these changes could hit you pretty hard.

Yesterday the federal government announced plans to cut $2.8 billion in university funding and jack up student fees. The new policies have already been met with strong criticism from student activists and the higher education sector, but there’s one big change the government is proposing that doesn’t just impact universities and students; it impacts every single person with a student debt. All 2.2 million of us.

The government is proposing to change the HECS repayment system by forcing graduates to pay off their debt earlier. The changes sound complicated and technical (because they are) but if they kick in from 2018, as the government plans, they will impact every single person with a student debt, regardless of when you studied.

The changes mean that lower-income graduates will be affected most, but the government argues that this is necessary to protect the “sustainability” of the system. So let’s take a look at what these changes mean in dollar terms.

A Great Big New Tax?

The HECS repayment system works a lot like income tax. Depending on how much you earn every year, you pay a proportion of your income back to the government until your debt is paid off. But there’s one crucial difference to HECS repayments and tax in terms of how they operate.

In Australia you only start paying income tax once you earn over $18,200 a year. The income tax rate for that bracket is 19 percent. That means you pay 19 cents in every $1 you earn over $18,200. You don’t pay tax on any income under that threshold.

But that’s not how HECS works. At the moment you only start repaying your student debt if you earn over $52,000 a year. But once you cross that threshold you pay the repayment rate of 2 percent on all your income, not just the amount above $52,000. That translates to $1,040 a year in minimum repayments for someone on that income.

If the government gets its way, that could all change from 2018. They’re planning to lower the threshold and increase the repayment rates.

We’ve Done The Numbers

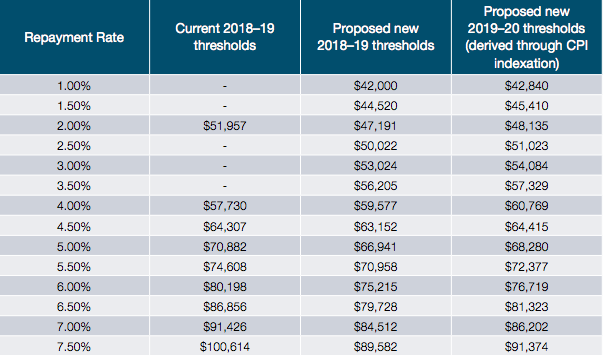

The government has released a table showing the new thresholds and repayment rates:

The new threshold for repayment will kick in at $42,000 and if you earn that income you’ll be required to pay back 1 percent ($420) a year. That new threshold is less than the current national median wage of $54,000.

By dropping the threshold, an additional 180,000 people will be required to start paying back their debt and 62 percent of them are women. But it’s not just low-income earners who will be impacted. People on median incomes will also be hit.

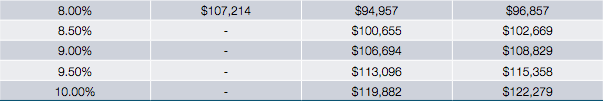

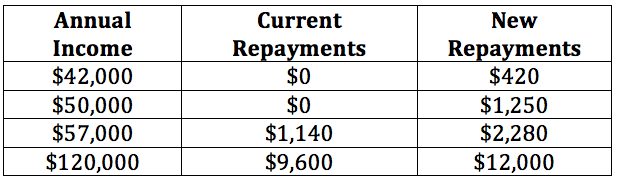

At the moment someone earning just over $50,000 isn’t required to make any HECS repayments. Under the new system they’ll be forking out $1,250 a year. People earning $57,000 will have their repayments doubled from $1,140 to $2,280.

On the top end of the income spectrum graduates earning over $120,000 will have a new 10 percent repayment rate. They’ll be paying $12,000 a year in repayments.

Some examples of how the changes will impact graduates.

If you want to find out how the changes could impact you, check out this cool little tool over at The Guardian.

Looking at this optimistically, the changes mean that graduates could end up paying off their debts faster. But until that happens, their disposable income will take a solid hit making it all that much harder to save up.

The increases to student fees mean that new students will be hit harder by this package of reforms, but everyone with a HECS debt will be impacted. The government will argue that middle-income earners need to pay more to make the system “sustainable” but it will be interesting to see who else is asked to do their ‘fair share’ in this year’s budget. Like, for example, property investors.

–

Osman Faruqi is Junkee’s News and Politics Editor. You can follow him on Twitter at @oz_f.