No Matter What The Government Tells You, This Budget Benefits The Rich More Than Anyone Else

Here are all the experts who say the government's mostly helping the rich.

Last night in his budget reply speech, opposition leader Bill Shorten told the government that the massive tax cuts at the centre of its budget were wrong, and proposed his own, bigger tax cuts.

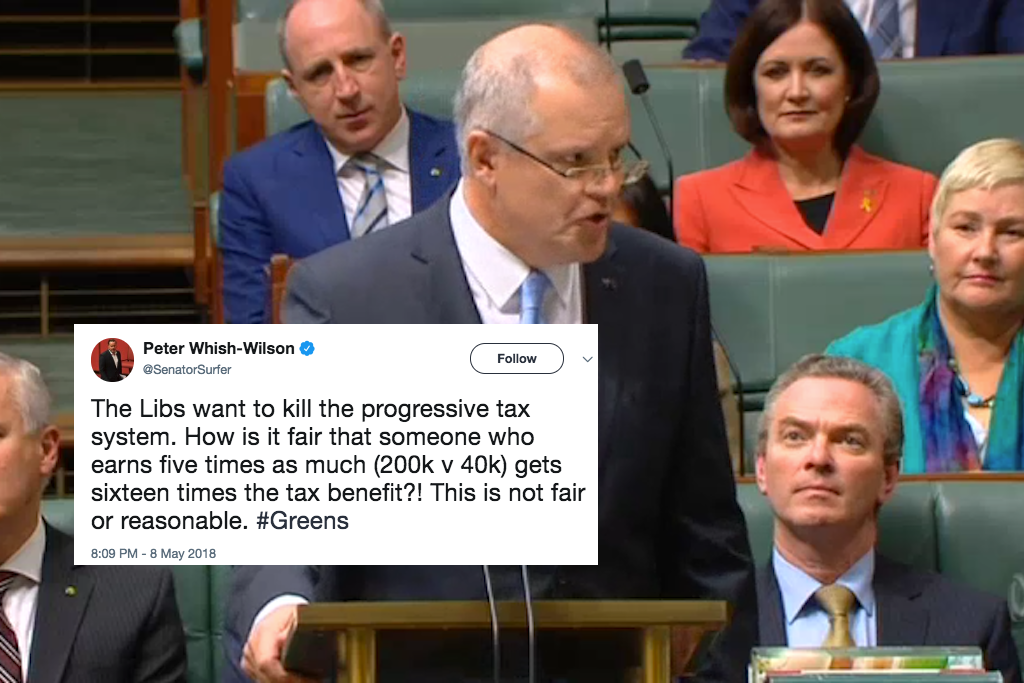

As Shorten put it, the Coalition government’s proposed tax cuts are “starting to look like a mate’s rates tax plan” — they largely benefit the rich, not average Australians. In a rare moment for politics, Shorten’s comments weren’t just spin: the expert advice is in, and no matter what the government tells you, this budget benefits the rich.

Here’s that expert advice, so we can settle this once and for all. Yesterday the National Centre for Social and Economic Modelling (Natsem), which is one of Australia’s leading independent economic and social policy research centres, released its analysis of the 2018 Budget. That analysis made it very clear that most of the benefit of Scott Morrison’s tax cuts will go to rich people in Australian cities — Like Malcolm Turnbull’s electorate of Wentworth, which is centred on the battler suburb of… Bondi.

As for everyone else, the benefits were much, much slimmer. And as for people earning no income, things are even more grim. “Although there are no significant losers under the 2018 budget,” Natsem wrote, “a segment of the population will not benefit from any of the proposed measures. This includes pensioners with no income and the unemployed”.

That’s because the government’s whole budget plan is based on taxable income — if you don’t pay tax, you don’t get the benefit, even if you probably need it more.

Stunning graphic, via @NATSEM_UC. How each wave of budget tax cuts benefits high earners more: https://t.co/OiwlaEehdi @smh @theage #auspol #ausecon pic.twitter.com/yru0xwMU2r

— Peter Martin (@1petermartin) May 10, 2018

Here’s an example with some actual numbers: according to Natsem data, the average person in Sydney’s wealthy Mosman area will be about $9000 better off by the time the tax changes come into full effect in 2024-25. By contrast, the average person in working class Lakemba in south-western Sydney will be around $2700 better off. The average pensioner or homeless person will be no better off. Seems fair, yeah?

The Guardian has turned the Natsem numbers into an easy interactive that lets you check your suburb and see the difference in benefits on a map. If you’re familiar at all with the wealthy suburbs around you, you’ll pretty quickly see a pattern.

? budget means:

$3.76 a week for a minimum wage worker and $137.60 for someone on $200,000 a year. That the logic of #TenBuckTurnbull— Sally McManus (@sallymcmanus) May 11, 2018

Natsem’s not even the only expert group to come to these conclusions. The Australia Institute came to the same conclusion, writing that 62% of the benefits from the budgeted tax cuts will go to Australia’s highest income earners, while only 7% of the benefit will go to the bottom 30%. The Grattan Institute similarly wrote that $15 billion of the $25 billion this tax plan will cost the government each year is going towards giving tax cuts to the top 20% — people earning more than $87,000.

Let’s have that one more time: the government is effectively going to spend $15 billion every year so that rich people can pay less tax. Not a single cent of that $15 billion is going to the average Australian, just to the rich.

These are the conclusions drawn by a series of experts — these institutes are the peak bodies for economic policy analysis in the country. Experts agree that this budget’s tax cuts overwhelmingly help the rich, not the middle class or working class Australians the government says they’ll help. Don’t let the government tell you otherwise.