Saving Up For A House Could Take You 40 Years, So You May As Well Spend Your Cash On Avo TBH

And unless something changes young people might never be able to buy a house!

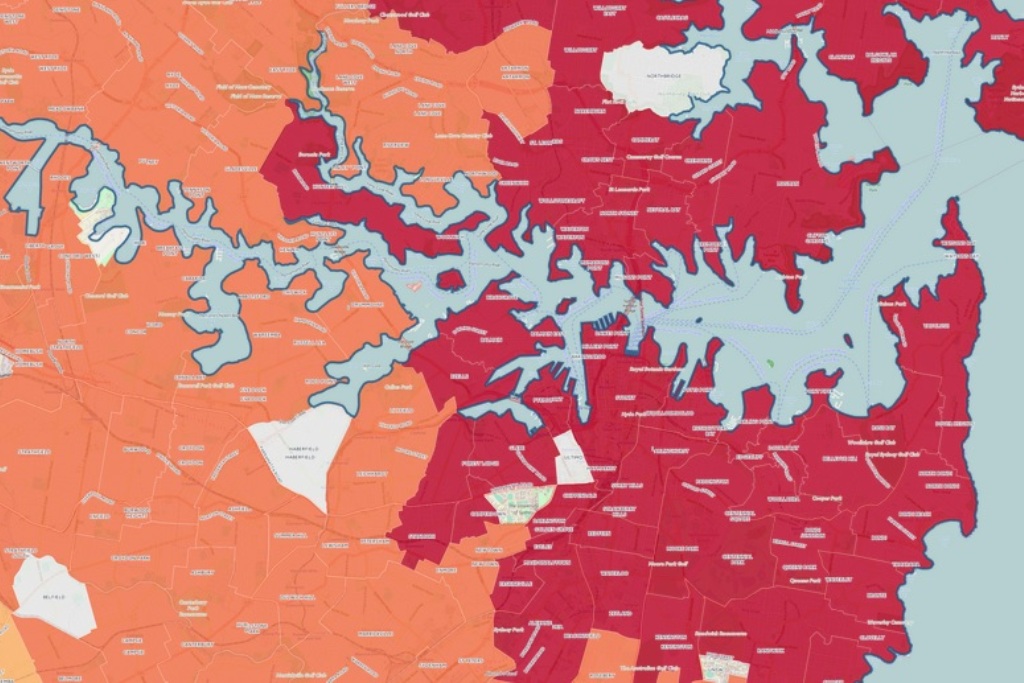

The future of the housing market in Australia continues to look pretty bloody grim. A new report has crunched the numbers and found that it would take 40 years for someone on an average salary to save up for a house in Sydney.

The report, released by financial services company UBS, says that the average cost of a house in Australia is now six and a half times the average wage. That figure has doubled in just two decades and it’s a major obstacle to first home buyers.

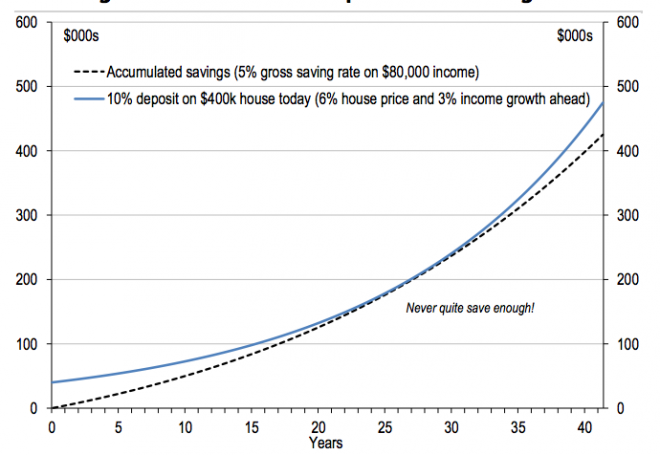

According to UBS, the average price for a first home in Australia is $400,000. On an $80,000 annual income, it will take a first home buyer roughly 11 years to put down a 10 percent deposit assuming they’re saving 5 percent of their income.

That doesn’t too bad right? Unfortunately it all gets much worse when you look at the big cities, where most Australians live. The average Sydney house price is $1.2 million, which means it will take up to 40 years just to save for a deposit, according to UBS. In Melbourne, it will take around 24 years with a median house price of $850,000.

Somehow, It Gets Worse

Unfortunately, UBS don’t see the house prices dropping anytime soon. The growth in annual household income is slower than the increase of housing prices, only making it more difficult for new buyers.

“In the last five years, house price growth averaged seven percent, but income only four percent. If this were to be repeated ahead, a [first home buyer] would likely never be able to save a 10 percent deposit,” the report states.

“Likely never be able to save a deposit.” Cool.

“Never quite save enough!!!! D:” Source: UBS

The right solution to housing affordability is being heavily contested by different political parties. Labor and the Greens have called for reforms to negative gearing to allow first-home buyers to enter the property market more easily. But the Coalition government made no mention of negative gearing reform in the Federal Budget, instead announcing a plan allowing first-home buyers to divert $30,000 from their superannuation funds towards a house deposit.

This measure has been pretty heavily criticised, including by the Financial Planning Association (FPA).

“While the FPA supports initiatives to make housing more affordable, the association says accessing super is not the solution to the housing affordability issue, and is not in the national interest.”

The new UBS report is, unfortunately, just the latest set of numbers to lay out how bleak the housing market is. The annual Rental Affordability Index released last month found that affordable housing in Australia’s capital cities was pretty much non-existent.

Sorry, everyone.