Why Did The Senate Just Vote To Keep The Tampon Tax?

"Periods are not a luxury, and sanitary items are not luxury items." - Larissa Waters.

Ever since the tampon tax was introduced in 2000 as part of the government’s 10 percent goods and services tax on “non-essential” health items, it’s been criticised as an overtly sexist example of policy making. While John Howard and co. found ways to exempt condoms, lubricant, sunscreen, nicotine patches and incontinence pads from the GST, something about bleeding vaginas failed to garner their sympathies.

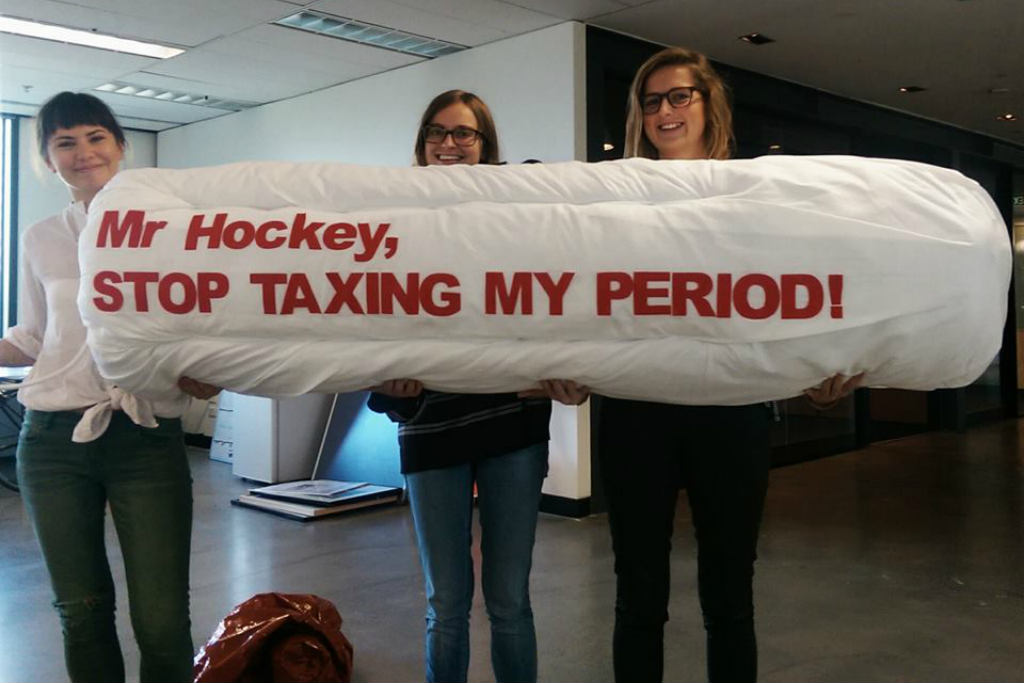

Refusing to exempt feminine hygiene products speaks volumes about our government’s attitude to women’s/trans’ health, and it’s a goddamn joke the tax has remained despite 17 years of intermittent mass protests, petitions, and Q&A promises from one Joe Hockey.

Now, our major parties have once again failed anyone who deigns to bleed from a vagina, with a Greens amendment to abolish the GST on sanitary goods failing 33-15 in the Senate earlier today. The Greens, Nick Xenophon team, Derryn Hinch, David Leyonhjelm and Lucy Gichuhi were the only ones to vote in favour.

At the weekend Labor held its National Labor Women's Conference.

Today it's voting against an amendment to remove GST from tampons etc.— Stephanie Peatling (@srpeatling) June 19, 2017

Greens Senator and spokesperson for women Larissa Waters hit out at both Labor and Coalition members for not supporting a change to the Treasury Laws Amendment (GST Low Value Goods) Bill, arguing that they have in effect voted to “keep taxing women’s biology”.

“Periods are not a luxury, and sanitary items are not luxury items — they are necessities,” Waters said. “Labor and the Coalition could stop tax breaks to big business and property tycoons instead they chose to penalise women for existing.

“Perhaps if there was a cashed up women’s lobby that made millions in donations with access to politicians the story would be very different”.

The Liberals and Labor just voted down a Greens amendment to axe the tampon tax. What a bloody disgrace. pic.twitter.com/FZRVo6Uy8X

— Larissa Waters (@larissawaters) June 19, 2017

Waters also drew attention to the bill’s broader impact. It proposes introducing GST on items bought online for under $1,000, which is expected to raise an extra $300 million over the next three years. But, after another Senate vote today, that will only be implemented from next year.

She argued that the bill — under recent modelling conducted by the Parliamentary Budget Office — means the online GST would more than offset removing the tampon tax:

“The states could axe the tampon tax and still be $185 million better off after the government’s proposed changes to the GST,” Waters said. “Revenue loss is no longer a credible excuse for refusing to axe the sexist tampon tax.”

Remember the Tampon Tax? Turns out it only raises $40 million a year in GST for states & territories. https://t.co/RYGigOaqJy pic.twitter.com/REl49dOHwm

— Alice Workman (@workmanalice) June 13, 2017

So, What’s Going On?

Both Labor and the Coalition have effectively shifted blame to the states and territories, as GST changes have historically required universal support.

“The Commonwealth put this issue on the agenda at a meeting in 2015 of state and territory treasurers, but there wasn’t unanimous support between the states and territories for removing the GST,” a spokesperson for treasurer Scott Morrison told BuzzFeed last week. “Unanimous support between the states and territories is required for any GST change.”

Shadow treasurer Chris Bowen similarly told BuzzFeed that Labor “strongly believes” in removing the tax, but enacting it through an amendment would effectively tank the bill.

This seemingly contradicts Bill Shorten’s claim during last year’s election that he would not scrap the tax if elected PM. But, like Morrison, he has a point: GST changes have required state approval by convention. And unfortunately, only Queensland, Victoria, South Australia and the ACT governments have declared their support in removing the tax.

Larissa Waters has written to the WA, NSW, NT and Tasmanian governments in an effort to bring the remaining states on board but, if NSW Premier Gladys Berejiklian’s comments as treasurer in 2015 are any indication, it’s going to be an uphill battle.

… Does That Actually Matter?

The truth is both Labor and the Coalition could have voted on these changes if they really wanted to; they would have pissed off the states, but GST remains a federal issue and the whole “universal support” has only come by convention.

“There is no rule that the states and territories have to agree to changes to the GST. If they won’t act, the federal government should [step in] to end this sexist taxation,” Waters told Junkee. “Labor are grasping at straws to disguise their own lack of support for removing the tampon tax, as articulated by Bill Shorten and Chris Bowen pre-election.”

“In any event, half the states and territories support removing this sexist tax, and I have written to the remaining states and territories asking them to reconsider their position,” she said.

If you take any of the parties’ other statements into account, you’ll see there wasn’t any support for the changes themselves. The only other Coalition comments seems to have come from Finance Minister Mathias Cormann, who pointed out tampons are not considered luxury goods; they just aren’t exempt from GST (which, you know, means effectively the same thing, but technicalities woo!).

Labor’s Katy Gallagher also said Labor supports the change to the way sanitary goods are treated “in principle”, they just don’t want to rush into anything. Reminder for everyone playing at home: they’ve had 17 years.

Labor has voted against removing the tampon tax… here’s the reasoning: https://t.co/3VCMFnQxgX pic.twitter.com/8XVdkEi9Q7

— Mark Di Stefano ?? (@MarkDiStef) June 19, 2017

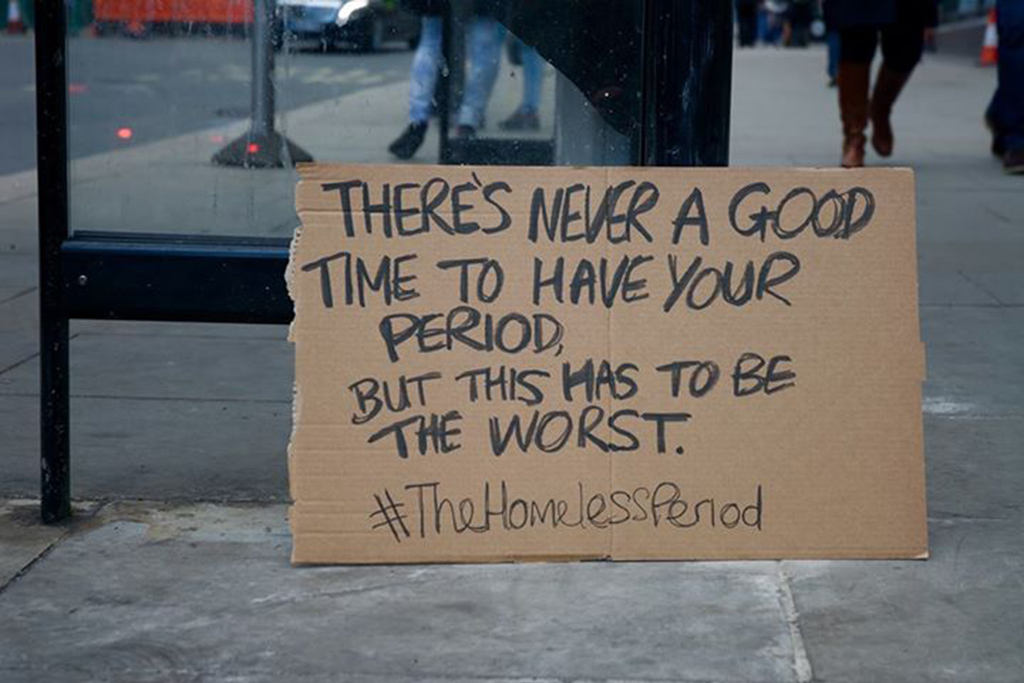

Finally, the tampon tax is one of the most clear-cut examples of male privilege out there: as important as those other hygiene products might be, periods are a part of life for women/trans-men/some non-binary people. Treating them as a non-issue has become part and parcel for the government, but they will eventually have to answer to public outrage.

Basically, keep up the pressure folks, and don’t let them stall.

Does anyone know a way I can give my period to male politicians? Maybe then they'll vote for removing the #tampontax

— Maddy Spooner (@mspooner98) June 19, 2017

–

Feature image: GetUp!/Twitter.

–

Chris Woods is a Melbourne-based freelance journalist.