The Government Is Trying To Pretend It’s Not Giving Rich Australians A Massive Tax Cut

Spoiler: They are.

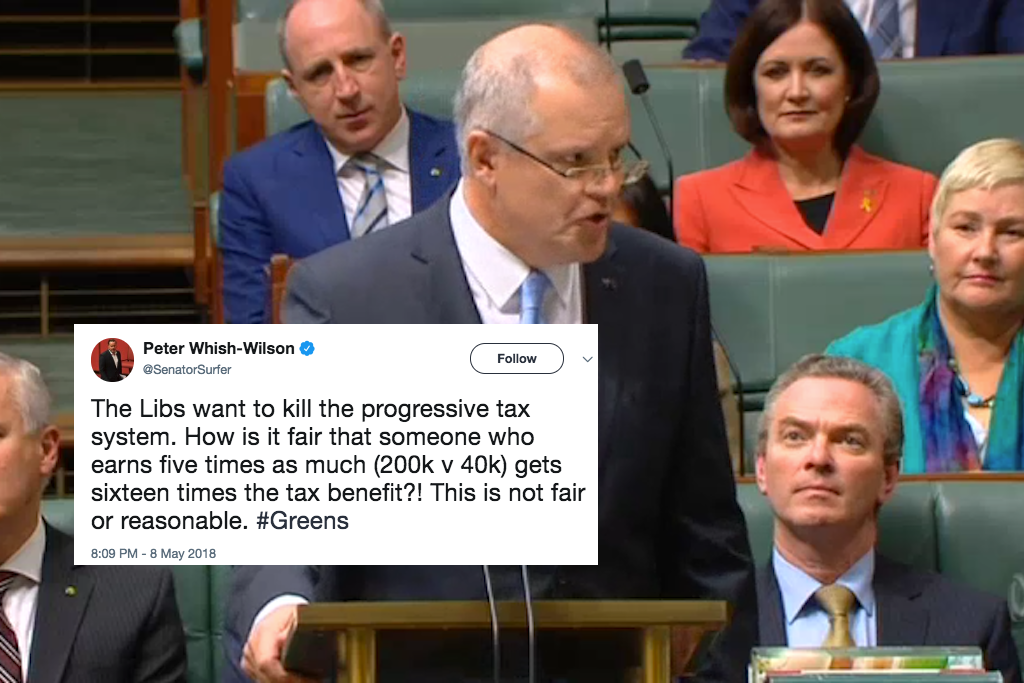

Yesterday, Prime Minister Scott Morrison was asked how his government’s planned tax cuts would affect Australians on high incomes. “We haven’t changed anything for those earning on the top tax rate,” was his response.

Trouble is, that’s not quite true. The government’s own budget papers show that people earning more than $200,000 will be getting an income tax cut of around $11,000 a year from 2024, when the Coalition’s full tax plan is in place. That adds up — a few weeks ago, The Australia Institute released modelling suggesting that over ten years, the government will spend $77 billion on tax cuts for Australians earning more than $180,000.

Scott Morrison and friends, however, seem determined to ignore that number. In fact, every time they get asked to explain it, they’ve been dodging the question. Here’s what’s going on.

.@ScottMorrisonMP says "we haven't changed anything for those earning on the top tax rate." (Budget papers show they get a $11k tax cut)

— David Speers (@David_Speers) May 6, 2019

What Has The Government Been Saying?

The government has repeatedly been asked to answer two pretty simple questions: firstly, is it providing a tax cut for Australians on incomes above $180,000, and secondly, how much is that tax cut costing taxpayers? Here’s how they’ve answered those questions so far.

On Sky News yesterday, Treasurer Josh Frydenberg was asked directly: “what is the tax relief that you’re planning for income earners over $180,000 a year?”. He talked for several minutes without answering the question.

“You’re still not putting a figure on it,” the interviewer pointed out, to which Frydenberg responded “the only people who are putting a figure on it are The Australia Institute”, which he argued “is not an organisation that we take credibly” due to its left-wing views. He refused to say whether The Australia Institute is correct in saying that tax cuts for high income earners will cost $77 billion.

The closest Frydenberg got to giving us a number was this: “What it costs the budget is $95 billion dollars to reduce the rate of tax from 32.5 to 30 cents in the dollar, for those who are earning between $45,000 and $200,000”. In other words, the government is definitely spending $95 billion on a tax cut for a whole range of Australians, but they won’t say whether $77 billion worth of those tax cuts are going to the rich.

Later in the day, Scott Morrison similarly avoided the question, continuing to insist that “we haven’t changed anything for those earning on the top tax rate”. The closest we got to an honest answer from him was on 7.30 last night, where he was asked how much a person earning $200,000 a year will save under his tax plan. He admitted that the answer is “about $11,000″, but repeated that “the top rate of tax is unchanged”.

Are Rich People Getting A Tax Cut Or Not?? What’s Going On??

At this point, there’s a good chance you’re confused. How can the government claim that it hasn’t changed the top rate of tax, but also acknowledge that people paying that top rate will save $11,000 on tax under its plan?

The answer comes down to extremely careful wording, as well as the government relying on voters’ eyes glazing over once they said words like “marginal rate” and “budget papers”.

There are a few different parts to the government’s tax reform plan, but one of them involves gradually abolishing the second highest tax bracket (which currently covers people earning between $87,000 and $180,000), meaning that everyone earning between $45,000 and $180,000 will eventually be in the same tax bracket. The government also wants to adjust the upper limit of this tax bracket, moving it from $180,000 to $200,000. They also want to reduce the rate of tax for people in this bracket (it’s currently 32.5 percent, and it will go down to 30 percent).

All of that means that by 2024, everyone earning between $45,000 and $200,000 will fall into the second highest tax bracket, paying a tax at a rate of 30 percent. The highest tax bracket, meanwhile, will kick in when you earn more than $200,000, and the rate is the same as it always was: 45 percent.

Technically, then, the government has sort of been telling the truth: it isn’t planning to change the rate of the highest tax bracket, though it does plan to change where it starts. The government has also conveniently forgotten to point out that everyone who qualifies for the highest tax bracket is still affected by changes to the other tax brackets.

For example, if you earn more than $200,000 a year, you don’t pay the top rate of tax on that entire income. Instead, just like everyone else, you pay zero tax on the first chunk of your income (the first $18,200), then 19 cents for every dollar over $18,200 but below $37,000, then 32.5 cents for every dollar over $37,000 but below $90,000, then 37 cents for every dollar over $90,000 but below $180,000, then 45 cents for every dollar in the chunk of your income that actually makes it into the highest tax bracket (above $180,000).

The Coalition’s plan to delete that second highest tax bracket means that in future, a person earning $200,000 isn’t having their income split into nearly as many chunks. Remember that chunk where the government used to take 37 cents out of every dollar? Under the Coalition’s plan, they’ll only take 35 cents for each of those dollars, even if your total income is massive. And remember that $20,000 chunk right at the end (the amount of income above $180,000)? Instead of taking 45 cents from every dollar, the government will only take 30 cents.

If that makes sense to you, then you’ll see where that $11,000 saving is coming from — the government hasn’t changed the highest tax rate, but that doesn’t mean it hasn’t changed tax rates that affect our highest income earners. Have a play with the government’s own income tax calculator if you’re confused.

And So We’re Back To The Big Question: How Many Billions Of Dollars Is The Government Actually Just Giving Back To Rich People?

This is why everyone’s so busy asking the government to break down the cost of its tax policy — we don’t just want to know how much the government’s tax cuts cost overall; we also want to know how much of that cost is going straight to rich people.

The Australia Institute reckons that over the next ten years, the government will spend $77 billion dollars on tax cuts for people earning more than $180,000 a year. The government says it doesn’t trust that figure, but it’s refused to tell us what the actual number is. Until it does, it’s hard to trust claims that these very expensive tax cuts really are for “all Australians”.