Everything You Need To Know About The 2019 Federal Budget And Its Useless Surplus

What does "Back In Black" even mean, really?

Well, the 2019 Federal Budget is here, and by most accounts it’s honestly pretty boring. There’s a much-touted surplus, sure, but that doesn’t necessarily mean what you think. There’s much touted tax cuts, but they aren’t necessarily the great thing the government believes them to be.

Oh, and crucially, this budget could end up meaning nothing if the government doesn’t win the election. That’s a big one.

There’ll be plenty of budget analysis to come over the next few days, but if you just want to get your head around the basics for now, here’s a look at the big things announced in Josh Frydenberg’s first federal budget.

A Surplus Of Surpluses

The word “surplus” has been uttered way too many times tonight, but stay with me. The government is extremely proud to be delivering the first budget surplus in a decade — they even redesigned all their social media accounts to fit their “Back In Black” theme.

The Liberals official twitter account has literally gone black for #Budget2019.

Morrison & Frydenberg really want to make the "back in black" Budget happen. pic.twitter.com/12ayfCbKxq

— Alice Workman (@workmanalice) April 2, 2019

this looks like something you make on indesign for your dad's one-off performance at the RSL pic.twitter.com/P2ALBQGlHc

— Naaman Zhou (@naamanzhou) April 1, 2019

And yes, it’s true, this budget is projected to deliver a $7.1 billion surplus, with even larger surpluses forecast for future years. This sounds impressive, emphasis on sounds. For one, the surplus hasn’t happened yet, it’s just a projection: the size of the actual surplus will depend on what happens in the economy going forward.

Secondly, a surplus doesn’t mean that the government is no longer in debt — it just means that in a given financial year, the government is bringing in more money than it spends. A surplus is good because it allows the government to pay down some of its debts, but being in deficit is also not necessarily terrible if whatever the government’s spending its money on is important enough.

You Get A Tax Cut, And You Get A Tax Cut, And Yes, Even The Wealthy Get A Tax Cut

Carrying on from the surplus theme, this budget is chock full of tax cuts. In Josh Frydenberg’s very own words, this budget contains “the largest personal income tax cuts since the Howard government”.

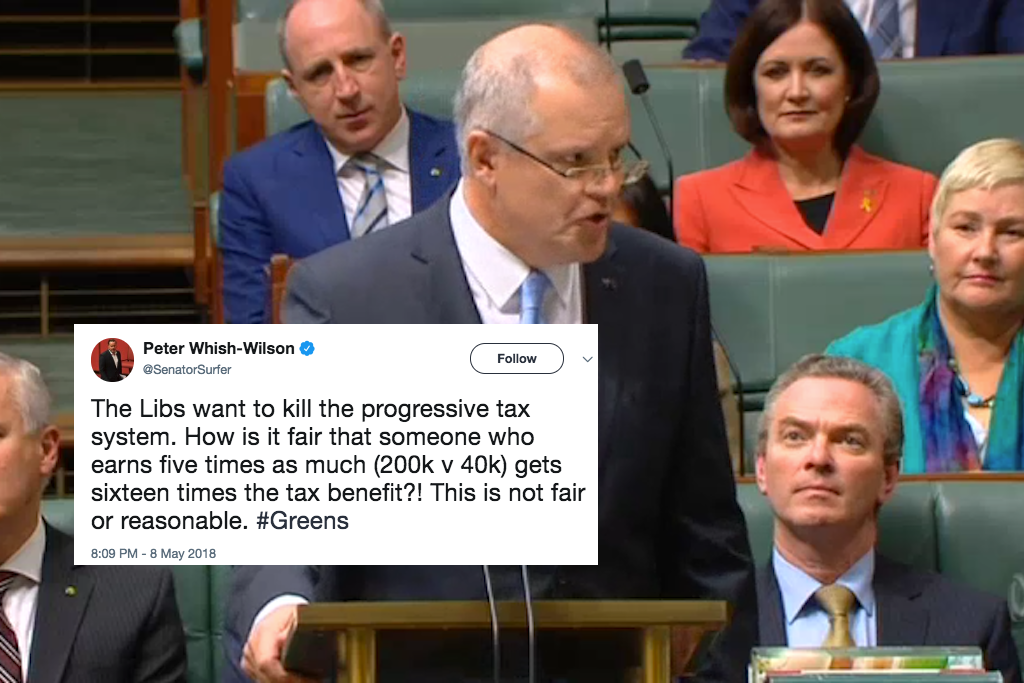

He said this very proudly, but like with the surplus, the Liberal Party being chuffed with something doesn’t necessarily mean it’s a good thing. The tax cuts included in this budget involve speeding up the tax cut plan from last budget, which overwhelmingly benefited rich Australians.

One of those tax cuts, as a refresher, is the elimination of the second-highest tax bracket, and the lowering of tax rates for the millions of Australians who now find themselves in the top tax bracket. In Josh Frydenberg’s words, “this will cover all taxpayers earning between $45,000 and $200,000, and will mean that 94% of all taxpayers will pay no more than 30 cents in the dollar.

As nice as that sounds for individuals, this is again probably not something we want. People earning $200,000 a year can probably afford to cop a higher tax rate than people on $45,000, after all.

Fast Trains That Never Arrive

“Busting congestion” was a big theme of this budget, and with those two words comes a familiar promise: fast rail.

As Greens MP Adam Bandt tweeted earlier tonight, “ah, fast rail. The train that runs once every election year”. See, we seem to get promised fast rail an awful lot in Australia — Labor also has a totally different fast rail plan amongst its election promises. And yet, despite many elections featuring speedy trains as a key promise, these trains have never quite arrived. For that reason, we’ll be taking this promise with a grain of salt.

Ah, fast rail. The train that runs once every election year.#Greens #Budget2019

— Adam Bandt (@AdamBandt) April 2, 2019

Funding for a bunch of other congestion-busting infrastructure projects was also spruiked in this year’s budget, but once again it’s important to remember that this is an election year, and tactical promises abound. On which note:

Unicorns, Everywhere!

There are quite a lot of shiny things in this budget. Tax cuts, for many Australians, sound lovely. So does fast rail. So does a budget surplus. So does increased funding for all kinds of things.

There are some other good things announced in the budget, like help for small businesses, funding for health and a Royal Commission into the disability sector, and help for drought stricken farmers. And there are some nasties, too, like an increased rollout of the controversial cashless welfare card, and continuing cuts to the ABC. And as usual, there’s no increase in Newstart. What a surprise.

But, at the risk of sounding like a broken record, it’s an election year, and this is an election budget. The government is pitching the kind of budget they hope will get them re-elected in a few weeks’ time — they also need to actually win the election to put this budget into practice.

you'll see a lot of reporting today presenting budget measures as a done deal ie "the government will do X". But if last 6 years have taught us anything it's that gov won't be able to pass a bunch of stuff, and based on current polling they won't be returned at election anyway

— Nick Evershed (@NickEvershed) April 1, 2019

At the moment, polling suggests that the government may not actually win that election, in which case this budget could mean very little at all. And even if the government does win the election, history tells us that many of its biggest promises will be challenged in Parliament before they come to play.

In that sense, this is a unicorn budget: full of lovely, shiny, wonderful things that just might not exist. It’s worth keeping that in mind, as the election debate gears up.

You Know What Else Doesn’t Exist? Climate Change, According To The Coalition

And speaking of things that don’t exist, let’s talk climate change. There is, unsurprisingly, not a lot going on in this budget as far as climate change goes.

The government, of course, will point to things like the $3.5 billion dollars earmarked for the Climate Solutions package, $2 billion of which “will go to practical emission reduction activities working with farmers and Indigenous communities”. The fact that only about three sentences of the budget actually dealt with climate change, though, pretty much sums up how much that will do.

Remember: The Election Is Coming

There are plenty of other points from the budget to tease out over the next few days. The approaching federal election, however, looms over all of this.

The government is expected to call the election some time in the next few weeks, most likely this weekend. That will put the date of the actual election some time in May. And as we’ve stressed above, the result of that election is going to determine whether this budget is actually implemented.

There’s a good chance that it won’t be, which makes taking a long, hard look at what’s being promised especially crucial. What’s being promised to win an election, and what’s being promised to actually benefit the country? What parts of this budget do you want to vote for, and what parts could you do without? Remember those, when the election finally comes.