The Doughnut Time Scandal Is Even Bigger Than We Thought

A whole bunch of businesses linked to the company's founder are in serious trouble.

Last week, the founder of popular dessert chain Doughnut Time announced the business had run out of money, and as a result the vast majority of stores would close. In an apparent last-minute lifeline, the former CEO offered to buy the company — salvaging the brand and keeping the business alive.

But this week news broke that the sale had fallen through: Doughnut Time went into liquidation last Friday, and all stores will close. It’s sad news for doughnut fans, but even sadder news for the company’s workers, who are now unlikely to receive thousands of dollars in back pay and entitlements, due to the company being wound up.

The announcement of Doughnut Time’s demise came as a surprise to workers, who had been promised they would be paid owed wages and superannuation. In some cases they had even been told they would still have jobs after the company changed hands.

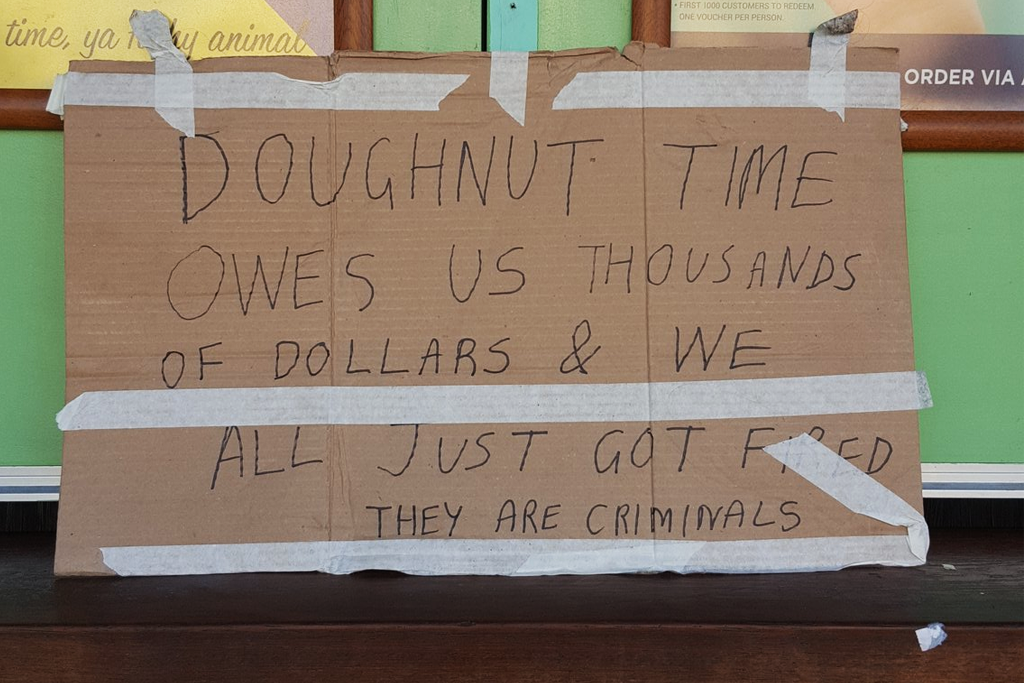

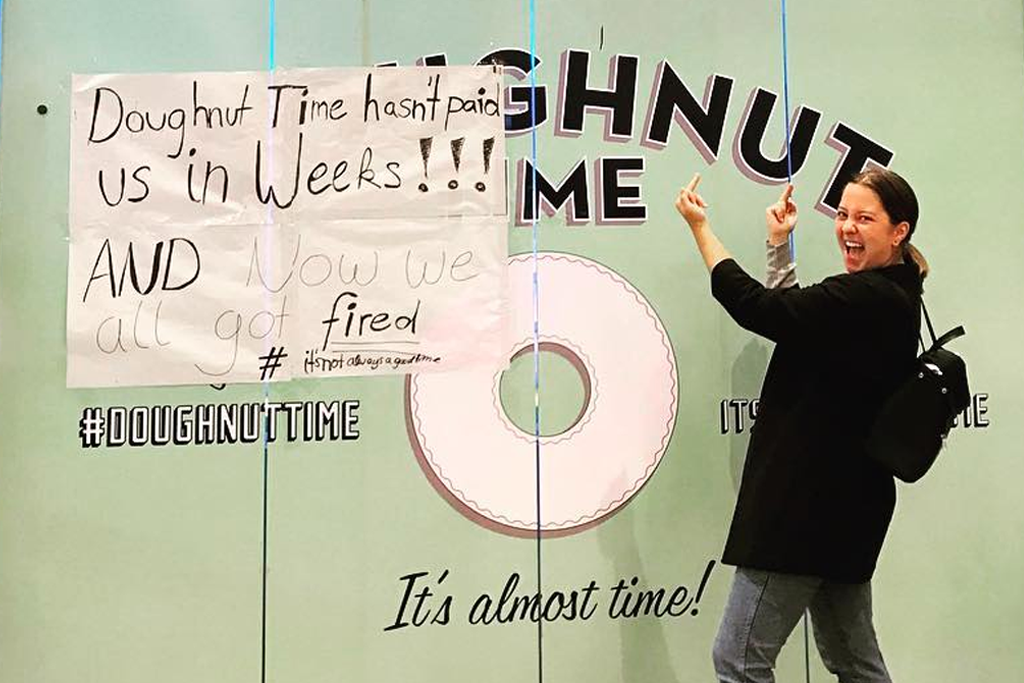

Handwritten signs began to appear on shuttered Doughnut Time stores, written by staff who alleged the company broke promises by assuring workers everything was fine, and then abruptly firing them without warning.

But Doughnut Time is not the only business associated with founder Damian Griffiths that is currently in deep financial trouble. As of January, Griffiths was listed as an officeholder of 22 different companies, six of which were in liquidation. Ten of the remaining companies were associated with Doughnut Time.

At least two of these businesses, much like Doughnut Time, owed wages or superannuation to employees, as well as substantial debts to the tax office. As legal action was being brought against one company (KTG Bakeries Pty Ltd), and debts were mounting for another (Bubbles Bar and Bistro Pty Ltd), Griffiths was on an overseas trip to launch an international expansion of Doughnut Time.

There is no allegation that Griffiths’ behaviour was illegal. But there were certainly warning signs that at least two of the businesses he owned were in a financially precarious state that would seriously affect the people who worked for them.

Who Is Damian Griffiths?

A quick primer on Damian Griffiths: in addition to founding Doughnut Time back in 2015, he’s also a bit of a hospitality mogul in the Brisbane suburb of Fortitude Valley.

He’s largely credited with transforming the hospitality and nightlife of the suburb. Starting in the mid-2000s, when he purchased and developed the Limes Hotel, he’s been adding numerous businesses to his portfolio, from the popular bar Alfred & Constance, to the restaurant Les Bubbles, eatery Kwan Brothers, ice cream store Mister Fitz’s Finest Ice Cream, Chester Street Cake Shop, and more. For the most part, these businesses occupied a single block in Fortitude Valley. Many shared space and clientele.

The future of many of these businesses is now uncertain, with their parent companies under external administration and potentially facing liquidation. Griffiths has sought to cast himself as a victim in the saga of his businesses’ collapse.

On December 13 last year, he told a Brisbane District Court that allegations he owed $500,000 were brought with “malice” by family members trying to bankrupt him. Speaking to media last week, he chalked the failure of Doughnut Time up to “a very tough retail environment”.

“I had a go and made lots of mistakes,” was his conclusion. While the lawsuit over the $500,000 played a significant role in Griffiths’ financial misfortunes, there was a lot more going on behind the scenes.

The Wind Up

In May 2017, pest-control company Rentokil filed a wind up application (a way of kicking off the process to sell off and deregister a company) against Alfred & The Kid Pty Ltd, where Griffiths was sole director and secretary, alleging that they were owed $14,402.88 for their services. $14,000 is a relatively small debt to try to have a company wound up over, and Griffiths fought it in court, eventually settling the matter for $22,000 including legal fees.

But in the second half of 2017, some of the other companies at which Griffiths was an officeholder began to face more claims about much larger debts they allegedly owed. In August, a former accounting service alleged that several of Griffiths’ companies collectively owed them $300,000. In November the ATO launched legal action against KTG Bakeries Pty Ltd, alleging that the company owed a cool $875,778 on taxes and superannuation dating back to early 2016. At the time, Griffiths was in London, launching an international expansion of Doughnut Time.

Also in November, the ATO launched legal action to wind up Bubbles Bar and Bistro Pty Ltd (the company behind Les Bubbles restaurant), over alleged debt of $423,491. And this one is where things start to get very interesting, because before administrators took over, the business was actually sold — to the same person who attempted to buy Doughnut Time.

Les Bubbles

On November 15, 2017, the ATO lodged a wind up application against the company behind Les Bubbles (Bubbles Bar & Bistro Pty Ltd), where Griffiths was the sole Director. On November 27, Griffiths’ good friend Dan Strachotta, who also happened to be the former CEO of Doughnut Time and the guy who tried (and failed) to buy the company, registered a new company called “Les Bubbles Restaurants Pty Ltd”. And on December 1st, Griffiths sold the Les Bubbles business to his friend without advertising the sale to the public.

All of this took place before external administrators took over to conduct a valuation of the company, and based on their report, they were not impressed. While none of this behaviour is illegal, the hasty nature of the sale was unusual, as was the fact that the administrators believed the business has been undervalued by around $170,466 — it was sold to Strachotta for $52,383, of which only $40,115 had been received by the time the administrators arrived.

If it was proven that the company was insolvent at the time, and also that the sale was genuinely undervalued, then Griffiths’ decision to sell it might be what’s known as an uncommercial transaction — one that a reasonable person in the company’s circumstances would not have made. Whether that’s the case remains to be proven, if ASIC, the government’s corporate regulator, chooses to investigate, or if a liquidator chooses to pursue the company’s debts.

The hasty sale wasn’t the only unusual thing the administrators noted. In a scathing 75 page report, they detailed a number of red flags at Bubbles Bar & Bistro Pty Ltd, as Griffiths’ company was known.

For starters, there were no accurate financial records. The company went through a number of different accounting services, and the last one had only prepared draft financial statements by the time the administrators needed them. It appeared that outstanding tax was not being properly recorded. Based on claims made by the ATO, it appeared that the company owed $93,148 in outstanding superannuation, and $545,534 in overdue taxes.

Despite these outstanding debts, the company had also loaned quite a bit of money to other companies with which Griffiths was involved. Doing so, again, is not necessarily illegal, but the fact that over $2 million appeared to be owed to Bubbles by those other companies that Griffiths was also involved with did not inspire confidence in the state of the business. Around $10 million dollars flowed through the company over the time it operated — a volume of cash the administrators described as “excessive” given the fact that the company’s net income for the period was just under $5 million.

Based on the figures on hand, the administrators’ investigation suggested that Bubbles may have been insolvent from as early as December 2015. These were only preliminary investigations, so should be taken with a grain of salt, but the figures were not encouraging. The administrators ultimately recommended that the company be liquidated.

What Difference Does This Make?

There’s a clear conclusion to be drawn from the administrators’ report into Les Bubbles: several business of which Damian Griffiths was a director were in deep financial trouble, maybe on the verge of collapse. And while there were, at least in some cases, signs that collapse could be imminent, it’s doubtful that many of his employees were aware of them.

These stories were emerging over the same time period that Doughnut Time management was reassuring workers that everything was fine.

On December 13 2017, right before administrators were appointed at Les Bubbles, Doughnut Time CEO Dan Strachotta sent a message to Doughnut Time staff saying pay would soon be up to date. His only oblique reference to what was happening in the other businesses was this: “we are having to restructure other businesses we own in Queensland. All of these changes are going to help Doughnut Time with sustainable growth”.

As one former employee, Todd, told Junkee: “we weren’t being told, we were just being constantly assured.”

The information that showed the company’s impending collapse was all publicly available. But finding it required the company’s workers to know where to look. Newspapers reported on individual developments for each business, but often behind a paywall. And there was no obvious way to link those companies back to Doughnut Time.

ASIC has files on all of the companies involved, but they’re not designed to be accessible to a casual worker concerned about their job.

Whether workers had access to this information matters though, because had workers known their employer was in a perilous position, they might not have trusted managers as their pay was repeatedly delayed. They might have begun searching for new jobs earlier, rather than being blindsided with Doughnut Time’s closure this week.

A sign taped to the front of a Doughnut Time store by workers who lost their jobs this week. Photo by Moira Cully on Twitter.

As Keelia Fitzpatrick, the co-ordinator of the Young Workers’ Centre, put it, “in most cases, workers have no right to access information about the financial stability of the business and they can’t know when their livelihood is at risk.”

“This is grossly unfair to workers and must change if we want to stamp out wage theft.”

“We need more publicly accessible information about business owners and directors so that workers can make informed choices before they start work. Businesses must be required to inform their staff about financial problems that may impact their pay and entitlements before it’s too late for them to take action. Business owners and directors who fail to do this must face penalties.”

This matters particularly for the many workers at Doughnut Time, and other similar businesses, who are international students or migrants. As Fitzpatrick noted, these workers are “exposed to even more risk because they cannot access even the most basic safety net in the Fair Entitlements Guarantee scheme (FEG)”, which workers who are Australian citizens can apply to to have their owed wages paid back now that Doughnut Time is in liquidation.

“Our system creates a second class of workers who can be left with absolutely nothing when a business fails,” Fitzpatrick said. “The limited scope of this so called safety net needs urgent reform. FEG must be accessible to all workers if we want to end the exploitation of migrant workers in Australia.”

What Does Damian Griffiths Have To Say About All This?

Damian Griffiths and Dan Strachotta, the two individuals at the centre of these business dealings, did not respond to our requests for comment on this story.

We’re not the only ones Griffiths hasn’t responded to. Multiple media organisations have struggled to reach him this week, and on Monday, Griffiths and his lawyers failed to show up to a Supreme Court hearing about a $400,000 lawsuit against Doughnut Time from the landlord of one of their Sydney stores.

That doesn’t make us optimistic about hearing back from him, but we’ll update this story if we do. You can read our previous coverage of the Doughnut Time saga here.

_

Feature image via Franka Deluca on Instagram.